1. Charging piles are energy supplement devices for new energy vehicles, and there are differences in development at home and abroad

1.1. The charging pile is an energy supplement device for new energy vehicles

The charging pile is a device for new energy vehicles to supplement electric energy. It is to new energy vehicles what a gas station is to fuel vehicles. The layout and usage scenarios of charging piles are more flexible than gas stations, and the types are also richer. According to the installation form, it can be divided into wall-mounted charging piles, vertical charging piles, mobile charging piles, etc., which are suitable for different site forms;

According to the classification of usage scenarios, it can be divided into public charging piles, special charging piles, private charging piles, etc. Public charging piles provide public charging services for the public, and special charging piles usually only serve the interior of the construction pile company, while private charging piles are installed in private charging piles. Parking spaces, not open to the public;

According to the classification of charging speed (charging power), it can be divided into fast charging piles and slow charging piles; according to the classification of charging technology, it can be divided into DC charging piles and AC charging piles. Generally speaking, DC charging piles have higher charging power and faster charging speed, while AC charging piles charge slower.

In the United States, charging piles are usually divided into different levels according to power, among which Level 1 and Level 2 are usually AC charging piles, which are suitable for almost all new energy vehicles, while tributary fast charging is not suitable for all new energy vehicles, and Various types are derived based on different interface standards such as J1772, CHAdeMO, Tesla, etc.

At present, there is no completely unified charging interface standard in the world. The main interface standards include China’s GB/T, Japan’s CHAOmedo, the European Union’s IEC 62196, the United States’ SAE J1772, and IEC 62196.

1.2. The growth of new energy vehicles and policy assistance drive the sustainable development of charging piles in my country

my country’s new energy vehicle industry is developing rapidly. my country’s new energy vehicles continue to develop, especially since 2020, the penetration rate of new energy vehicles has increased rapidly, and by 2022 the penetration rate of new energy vehicles has exceeded 25%. The number of new energy vehicles will also continue to increase. According to the statistics of the Ministry of Public Security, the proportion of new energy vehicles to the total number of vehicles in 2022 will reach 4.1%.

The state has issued a number of policies to support the development of the charging pile industry. The sales and ownership of new energy vehicles in my country continue to grow, and correspondingly, the demand for charging facilities continues to expand. In this regard, the state and relevant local departments have issued a number of policies to vigorously promote the development of the charging pile industry, including policy support and guidance, financial subsidies, and construction goals.

The state has issued a number of policies to support the development of the charging pile industry. The sales and ownership of new energy vehicles in my country continue to grow, and correspondingly, the demand for charging facilities continues to expand. In this regard, the state and relevant local departments have issued a number of policies to vigorously promote the development of the charging pile industry, including policy support and guidance, financial subsidies, and construction goals.

With the continuous growth of new energy vehicles and policy stimulation, the number of charging piles in my country continues to grow. As of April 2023, the number of charging piles in my country is 6.092 million. Among them, the number of public charging piles increased by 52% year-on-year to 2.025 million units, of which DC charging piles accounted for 42% and AC charging piles accounted for 58%. Since private charging piles are usually assembled with vehicles, the growth in ownership is even greater. Fast, with a year-on-year increase of 104% to 4.067 million units.

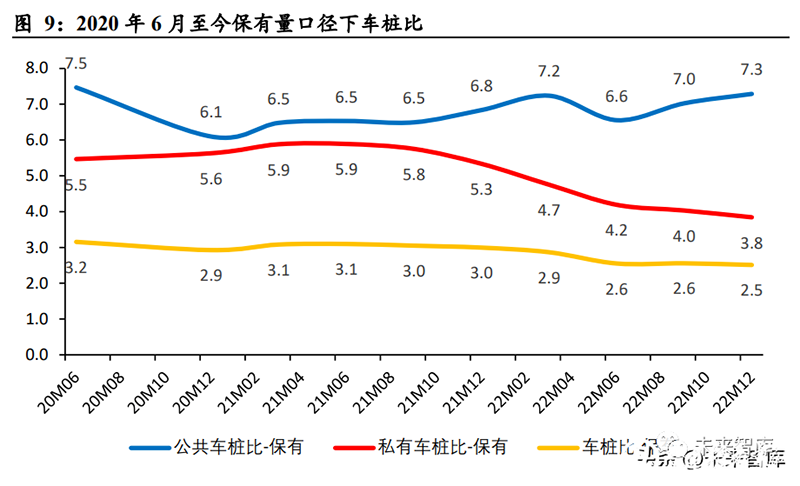

The vehicle-to-pile ratio in my country is 2.5:1, of which the public vehicle-to-pile ratio is 7.3:1. Vehicle-to-pile ratio, that is, the ratio of new energy vehicles to charging piles. From the perspective of inventory, by the end of 2022, the ratio of vehicles to piles in my country will be 2.5:1, and the overall trend is gradually declining, that is, the charging facilities for new energy vehicles are constantly being improved. Among them, the ratio of public vehicles to piles is 7.3:1, which has gradually increased since the end of 2020. The reason is that the sales of new energy vehicles have grown rapidly and the growth rate has exceeded the construction progress of public charging piles; the ratio of private vehicles to piles is 3.8:1, showing a gradual decline. The trend is mainly due to factors such as the effective promotion of national policies to promote the construction of private charging piles in residential communities.

In terms of the breakdown of public charging piles, the number of public DC piles: the number of public AC piles ≈ 4:6, so the ratio of public DC piles is about 17.2:1, which is higher than the ratio of public AC piles of 12.6:1.

In terms of the breakdown of public charging piles, the number of public DC piles: the number of public AC piles ≈ 4:6, so the ratio of public DC piles is about 17.2:1, which is higher than the ratio of public AC piles of 12.6:1.

The incremental vehicle-to-pile ratio shows a gradual improvement trend as a whole. From the incremental point of view, since the monthly new charging piles, especially the new public charging piles, are not closely related to the sales of new energy vehicles, they have large fluctuations and lead to fluctuations in the monthly new vehicle pile ratio. Therefore, quarterly The caliber is used to calculate the incremental vehicle-to-pile ratio, that is, the sales volume of newly added new energy vehicles: the number of newly added charging piles. In 2023Q1, the newly added car-to-pile ratio is 2.5:1, showing a gradual downward trend overall. Among them, the new public car-to-pile ratio is 9.8:1, and the newly added private car-to-pile ratio is 3.4:1, which also shows a significant improvement. trend.

1.3. The construction of overseas charging facilities is not perfect, and the growth potential is considerable

1.3.1. Europe: The development of new energy is different, but there are gaps in charging piles

New energy vehicles in Europe are developing rapidly and have a high penetration rate. Europe is one of the regions that attach the most importance to environmental protection in the world. Driven by policies and regulations, the European new energy vehicle industry is developing rapidly and the penetration rate of new energy is high. Reached 21.2%.

The vehicle-to-pile ratio in Europe is high, and there is a large gap in charging facilities. According to IEA statistics, the ratio of public vehicle piles in Europe will be about 14.4:1 in 2022, of which public fast charging piles will only account for 13%. Although the European new energy vehicle market is developing rapidly, the construction of matching charging facilities is relatively backward, and there are problems such as few charging facilities and slow charging speed.

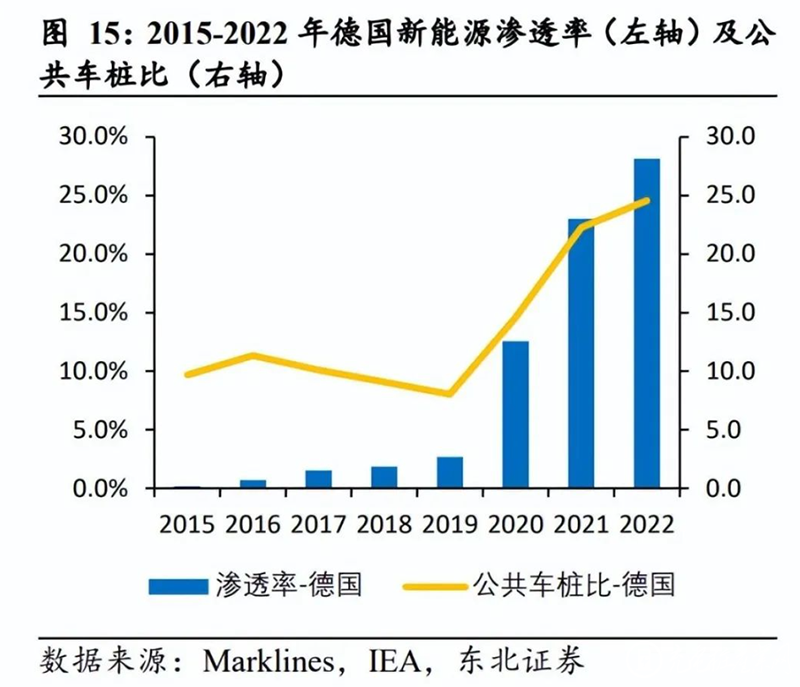

The development of new energy is uneven among European countries, and the ratio of public vehicles to piles is also different. In terms of subdivision, Norway and Sweden have the highest penetration rate of new energy, reaching 73.5% and 49.1% respectively in 2022, and the ratio of public vehicles to piles in the two countries is also higher than the European average, reaching 32.8:1 and 25.0 respectively: 1.

Germany, the United Kingdom, and France are the largest car sales countries in Europe, and the penetration rate of new energy is also high. In 2022, the new energy penetration rates in Germany, the United Kingdom, and France will reach 28.2%, 20.3%, and 17.3%, respectively, and the public vehicle-pile ratios will be 24.5:1, 18.8:1, and 11.8:1, respectively.

In terms of policies, the European Union and many European countries have successively introduced incentive policies or charging subsidy policies related to the construction of charging facilities to stimulate the development of charging facilities.

1.3.2. The United States: Charging facilities need to be developed urgently, and the government and enterprises work together

As one of the largest auto markets in the world, the United States has made slower progress in the field of new energy than China and Europe. In 2022, the sales of new energy vehicles will exceed 1 million, with a penetration rate of about 7.0%.

At the same time, the development of the public charging pile market in the United States is also relatively slow, and the public charging facilities are not complete. In 2022, the ratio of public vehicles to piles in the United States will be 23.1:1, of which public fast charging piles will account for 21.9%.

The United States and some states have also proposed stimulus policies for charging facilities, including a project by the US government to build 500,000 charging piles totaling US$7.5 billion. The total available to states under the NEVI program is $615 million in FY 2022 and $885 million in FY 2023. It is worth noting that the charging piles participating in the project of the US federal government must be manufactured in the United States (including manufacturing processes such as housing and assembly), and by July 2024, at least 55% of all component costs need to come from the United States.

In addition to policy incentives, charging pile companies and car companies have also actively promoted the construction of charging facilities, including Tesla’s opening of part of the charging network, and ChargePoint, BP and other car companies cooperating to deploy and build piles.

Many charging pile companies around the world are also actively investing in the United States to establish new headquarters, facilities or production lines to produce charging piles in the United States.

2. With the accelerated development of the industry, the overseas charging pile market is more flexible

2.1. The barrier to manufacturing lies in the charging module, and the barrier to going overseas lies in standard certification

2.1.1. The AC pile has low barriers, and the core of the DC pile is the charging module

The manufacturing barriers of AC charging piles are low, and the charging module in DC charging piles is the core component. From the perspective of working principle and composition structure, the AC/DC conversion of new energy vehicles is realized by the on-board charger inside the vehicle during AC charging, so the structure of the AC charging pile is relatively simple and the cost is low. In DC charging, the conversion process from AC to DC needs to be completed inside the charging pile, so it needs to be realized by the charging module. The charging module affects the stability of the circuit, the performance and safety of the whole pile. It is the core component of the DC charging pile and one of the components with the highest technical barriers. Charging module suppliers include Huawei, Infy power, Sinexcel, etc.

2.1.2. Passing overseas standard certification is a necessary condition for overseas business

Certification barriers exist in overseas markets. China, Europe, and the United States have issued relevant certification standards for charging piles, and passing certification is a prerequisite for entering the market. China’s certification standards include CQC, etc., but there is no mandatory certification standard for the time being. The certification standards in the United States include UL, FCC, Energy Star, etc. The certification standards in the European Union are mainly CE certification, and some European countries have also proposed their own subdivided certification standards. On the whole, the difficulty of certification standards is the United States > Europe > China.

2.2. Domestic: High concentration of operation end, fierce competition in the whole pile link, and continuous growth of space

The concentration of domestic charging pile operators is relatively high, and there are many competitors in the whole charging pile link, and the layout is relatively scattered. From the perspective of charging pile operators, Telephone and Xingxing Charging account for nearly 40% of the public charging pile market, and the market concentration is relatively high, CR5=69.1%, CR10=86.9%, of which the public DC pile market CR5=80.7%, The public communication pile market CR5=65.8%. Looking at the entire market from bottom to top, various operators have also formed different models, such as Telephone, Xingxing Charging, etc., laying out the upstream and downstream of the industrial chain including the entire manufacturing process, and there are also such as Xiaoju Charging, Cloud Quick Charging, etc. that adopt light The asset model provides third-party charging station solutions for the entire pile manufacturer or operator. There are many manufacturers of whole piles in China. Except for the vertical integration models such as Telephone and Star Charging, the whole pile structure is relatively scattered.

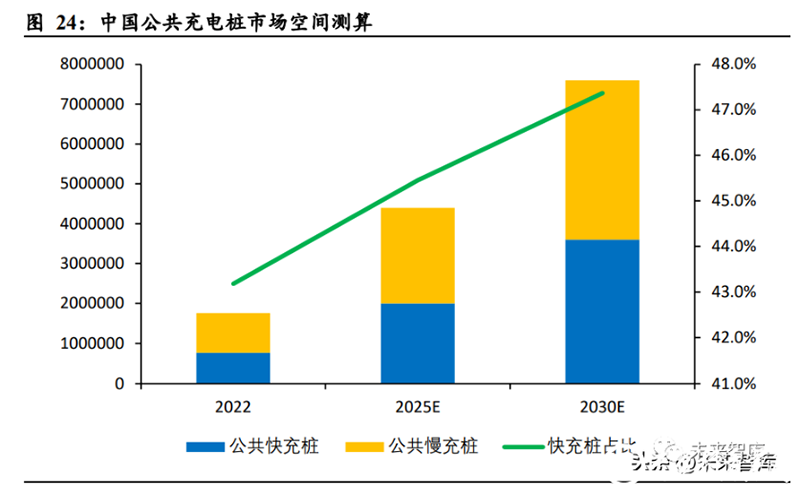

The number of public charging piles in my country is expected to reach 7.6 million by 2030. Considering the development of my country’s new energy vehicle industry and the policy planning of the country, provinces and cities, it is estimated that by 2025 and 2030, the number of public charging piles in China will reach 4.4 million and 7.6 million respectively, and 2022-2025E and 2025E The CAGR of -2030E is 35.7% and 11.6% respectively. At the same time, the proportion of public fast charging piles in public piles will also gradually increase. It is estimated that by 2030, 47.4% of public charging piles will be fast charging piles, further improving user experience.

2.3. Europe: The construction of charging piles is accelerating, and the proportion of fast charging piles is increasing

Taking the UK as an example, the market concentration of charging pile operators is lower than that of China. As one of the major new energy countries in Europe, the number of public charging piles in the UK will account for 9.9% in 2022. From the perspective of the British charging pile market, the overall market concentration is lower than that of the Chinese market. In the public charging pile market, ubitricity, Pod Point, bp pulse, etc. have a higher market share, CR5=45.3%. Public fast charging piles and ultra-fast charging piles Among them, InstaVolt, bp pulse, and Tesla Supercharger (including open and Tesla-specific ones) accounted for more than 10%, and CR5=52.7%. On the whole pile manufacturing side, major market players include ABB, Siemens, Schneider and other industrial giants in the field of electrification, as well as energy companies that realize the layout of the charging pile industry through acquisitions. For example, BP acquired one of the largest electric vehicle charging companies in the UK in 2018. 1. Chargemaster and Shell acquired ubitricity and others in 2021 (BP and Shell are both oil industry giants).

In 2030, the number of public charging piles in Europe is expected to reach 2.38 million, and the proportion of fast charging piles will continue to increase. According to estimates, by 2025 and 2030, the number of public charging piles in Europe will reach 1.2 million and 2.38 million respectively, and the CAGR of 2022-2025E and 2025E-2030E will be 32.8% and 14.7% respectively. will dominate, but the proportion of public fast charging piles is also increasing. It is estimated that by 2030, 20.2% of public charging piles will be fast charging piles.

2.4. The United States: The market space is more flexible, and local brands currently dominate

The charging network market concentration in the United States is higher than that in China and Europe, and local brands dominate. From the perspective of the number of charging network sites, ChargePoint occupies the leading position with a proportion of 54.9%, followed by Tesla with 10.9% (including Level 2 and DC Fast), followed by Blink and SemaCharge, which are also American companies. From the perspective of the number of charging EVSE ports, ChargePoint is still higher than other companies, accounting for 39.3%, followed by Tesla, accounting for 23.2% (including Level 2 and DC Fast), followed by mostly American companies.

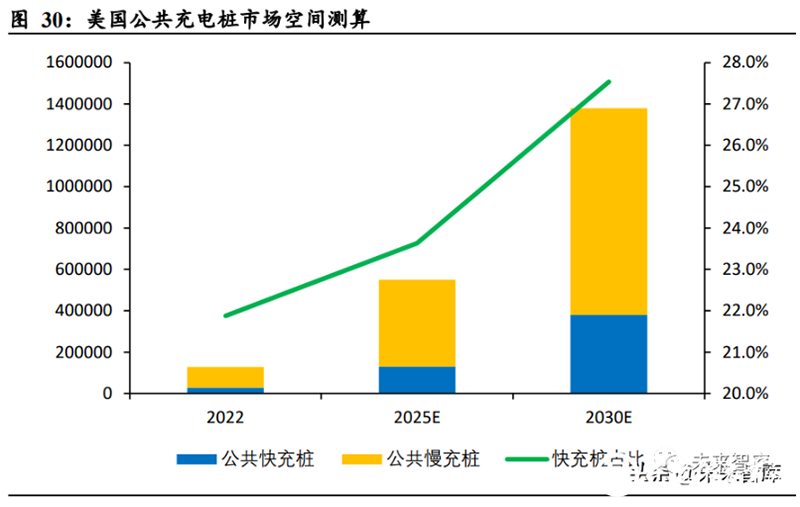

In 2030, the number of public charging piles in the United States is expected to reach 1.38 million, and the proportion of fast charging piles will continue to improve. According to estimates, by 2025 and 2030, the number of public charging piles in the United States will reach 550,000 and 1.38 million respectively, and the CAGR of 2022-2025E and 2025E-2030E will be 62.6% and 20.2%, respectively. Similar to the situation in Europe, Slow charging piles still occupy the majority, but the proportion of fast charging piles will continue to improve. It is estimated that by 2030, 27.5% of public charging piles will be fast charging piles.

Based on the above analysis of the public charging pile industry in China, Europe, and the United States, it is assumed that the number of public charging piles will grow at a CAGR during the period 2022-2025E, and the number of new charging piles added each year will be obtained by subtracting the number of holdings. In terms of product unit price, domestic slow-charging piles are priced at 2,000-4,000 yuan/set, and foreign prices are 300-600 dollars/set (that is, 2,100-4,300 yuan/set). The price of domestic 120kW fast-charging piles is 50,000-70,000 yuan/set, while the price of foreign 50-350kW fast-charging piles can reach 30,000-150,000 dollars/set, and the price of 120kW fast-charging piles is about 50,000-60,000 dollars/set. It is estimated that by 2025, the total market space of public charging piles in China, Europe, and the United States will reach 71.06 billion yuan.

3. Analysis of key companies

Overseas companies in the charging pile industry include ChargePoint, EVBox, Blink, BP Pulse, Shell, ABB, Siemens, etc. Domestic companies include Autel, Sinexcel, CHINAEVSE, TGOOD, Gresgying, etc. Among them, domestic pile companies have also made some progress in going overseas. For example, some products of CHINAEVSE have obtained UL, CSA,Energy Star certification in the United States and CE, UKCA, MID certification in the European Union. CHINAEVSE have entered BP List of charging pile suppliers and manufacturers.

Post time: Jul-10-2023